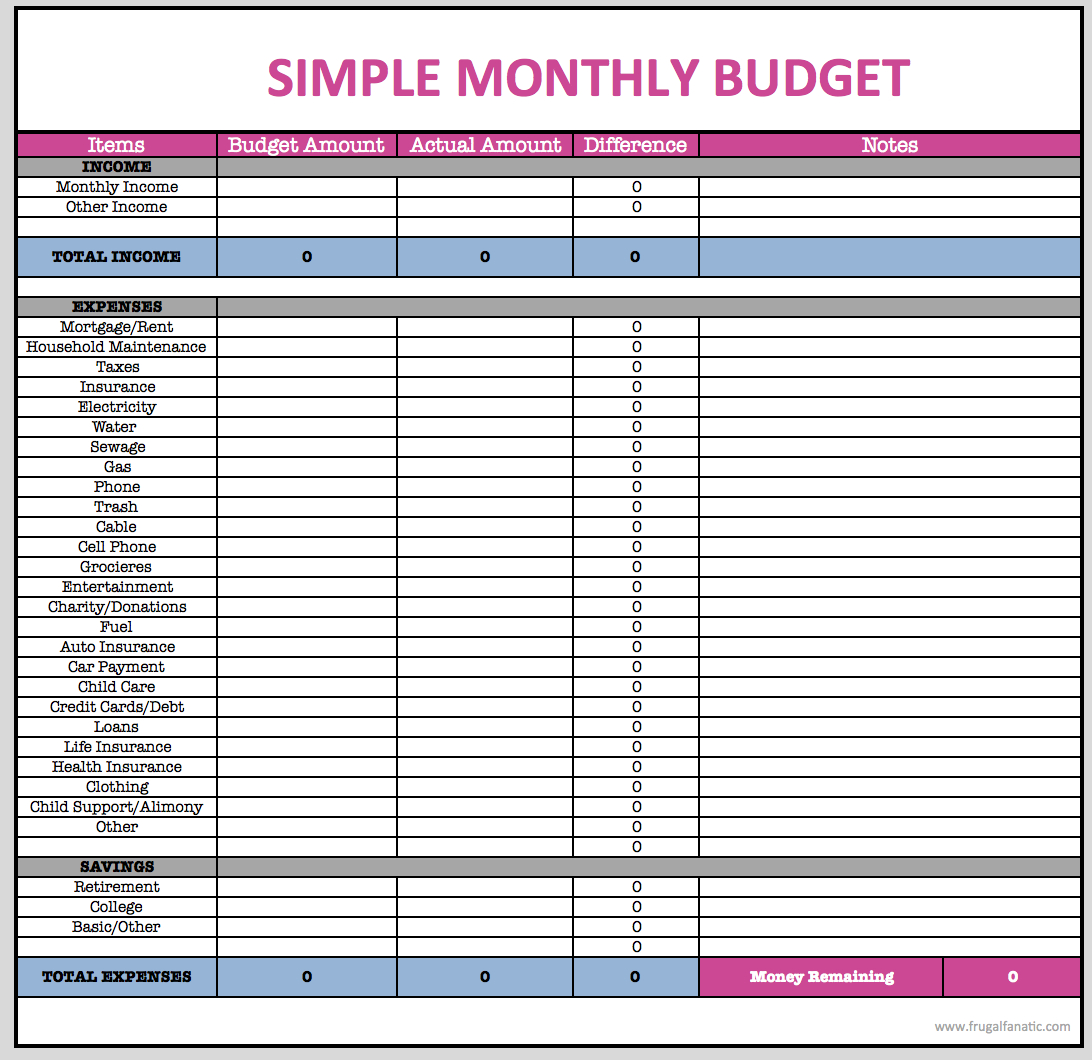

Early exposure to goal setting helps to give them patience and vision, two things they’ll need in life. CSS PROFILE, FAFSA, etc.) does not give our office a clear. Make sure that you include all take-home income and expenses as accurately as possible. Both of you should put down in the budget what they should save each month, and for how long, before they have enough to pay cash for a ride. The income reported on your financial aid applications (i.e. It classifies income, personnel expenses, and. At this age, their own car is probably the first thing on their minds. Home budget planner template is a print-ready design that works excellent with both laser and inkjet printers. Teach them about having long-term savings goals. You are letting them set their own priorities. If something is out of whack, you can correct it, but you’re not babying them. Let them know that this budget is theirs. Find out what they spend their money on and work out a plan with them. Sit down with your teen and show them how to make a budget. This workbook is filled with budgeting tips and practical money skills.

With your spouse, sit down and start filling the out the free printable household budget worksheet.

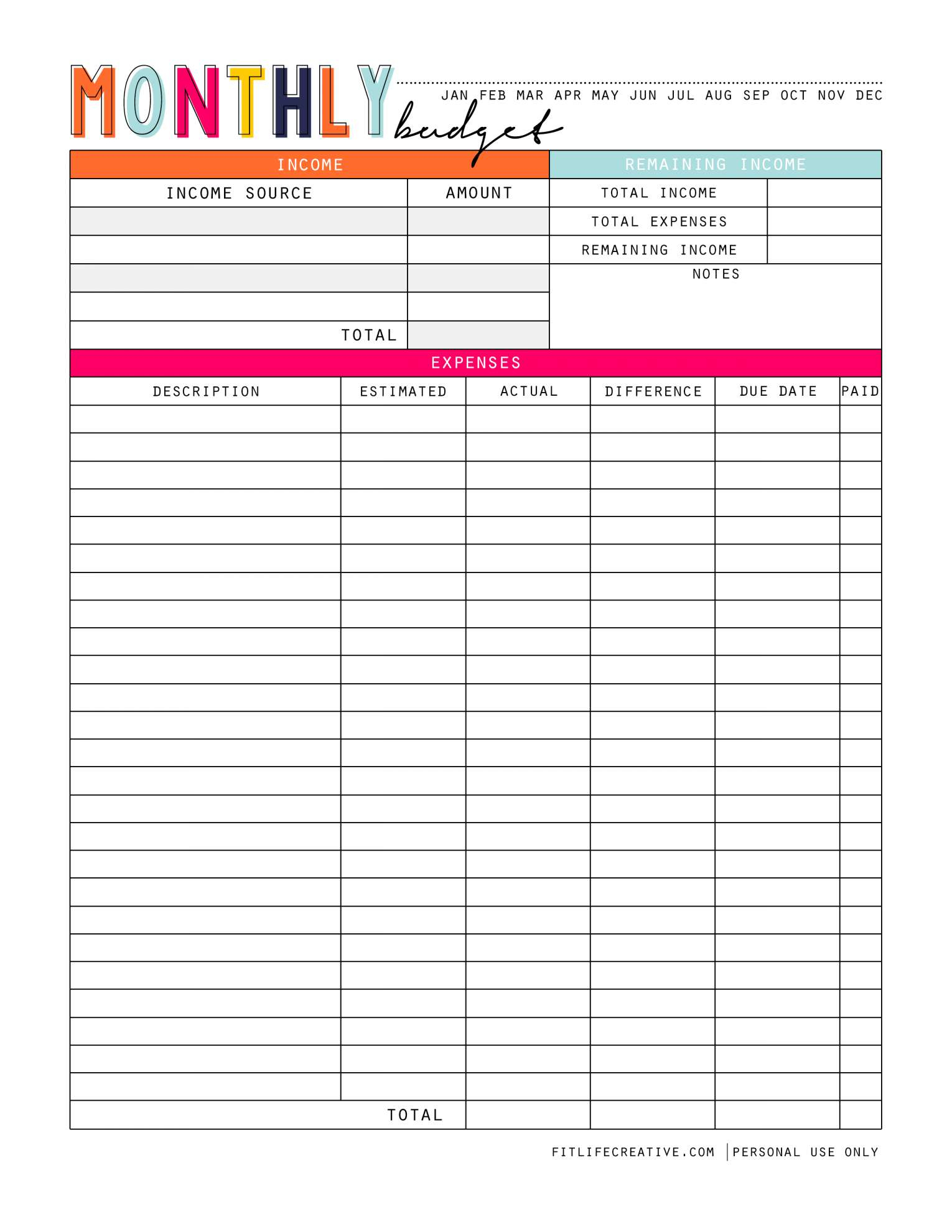

But if you like to plan everything with pen and paper, then budget printables will be a perfect solution for you. Complete this budgeting worksheet to see how far your take-home pay can go each month. Either print the free household budget worksheet PDF or open the Excel file. If you’re 100% digital person, you’re likely to google a smartphone app, excel templates or any other best online budgeting sites. You can print out what you want and archive the rest of the forms to your local drive. The full-size worksheets in PDF format allow you to print out the worksheets on 8.5 x 11 paper. When it comes to tools that can help you achieve that, there are plenty of mediums to choose from. To get started, download your PDF worksheets and refer to the Budget Kit eBook when you have questions regarding the worksheets. It highlights information like month name, total due, total wages and total leftover. This simple budget template provides you with a table depicting information which is divided into the Home column with a ready list of expenses, the amount and due date. A great advantage of having a budget is a possibility to track your spending habits over time and adjust them accordingly. The main purpose is to help you calculate how much you spend and save each month. It’s to help you plan for how, what for and how much money will be spent or saved during a particular period of time. A budget is a structured list of your personal or household expected income and expenses. Whatever you may need money for, it’s important that you stick to your budget day in and day out. You don't want to get a negative balance of your credit card, don't you? Moreover, keeping track of your finances can play an important role in the pace you improve your savings account balance and save money for your dream vacation, house or car. In the world of consumerism, it’s easy to spend a few bucks here and there to suddenly find out that you exceeded your daily, weekly or monthly budget. The ability to manage your cash flow and track your income and expense is vital. Each expense category has a recommended distribution of your income associated with it. Because it's not only business people who care about profits and expenses. Household Budgeting Worksheet For more information about managing your finances call 80 to speak to a credit counselor today Make sure that you include all net or take-home income and expenses as accurately as possible. It's no wonder why one of the many tips on personal finance management is to make budget.Īnd you don't have to be a financial specialist to do that. What can be more important than time management? Correct.

0 kommentar(er)

0 kommentar(er)